A landlords guide to UK house price predictions for next 5 years

Landlords should pay attention to house prices and whether they are set to go or down.

The future resale value of a property is likely to increase if average prices are going up. It may not be a good time to sell if they are going down, but it could be the right time to buy.

UK house price growth has been consistent strong and consistent since the global financial crisis in 2008. Demand for homes is outstripping supply, which causes an increase in house prices.

Average prices have increased even quicker from 2020, as a result of the Covid-19 pandemic, when the government introduced a stamp duty holiday and more people relocated.

There were bug jumps in average property prices between 2020 and 2022, but growth stalled over the next year with price drops recorded in many areas.

A combination of economic uncertainty, a cost of living crisis, high interest rates, and rising inflation, which made it harder for people to buy properties, was the cause.

During 2024 average prices have started to grow again, albeit at a much slower rate than before.

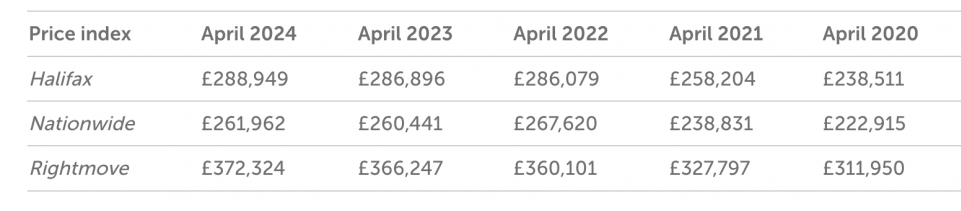

Here’s an overview of average house prices over the last five years from some of the main data providers:

*Halifax and Nationwide figures are based on purchase prices from approved mortgages. Rightmove figures are based on asking prices for homes for sale

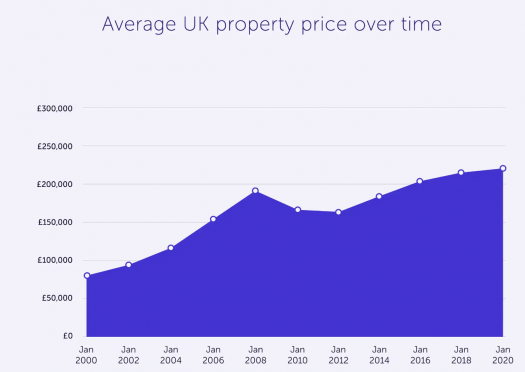

The below graph shows average UK house price growth over the last 20 years, according to the Land Registry.

Graph showing the average UK property price between 2000 and 2020

Between January 2000 and January 2020, the average property price in the UK increased from £84,620 to £231,940 – a £147,320 rise, equivalent to 174 per cent.

UK housing market predictions for 2024

Most mortgage providers and property experts forecast that house prices would fall or rise slightly at the start of 2024 and during the year.

Compared to significant drops forecast in 2023, reasons for these more positive predictions included a stable economic outlook and low unemployment rates.

Falling inflation and competition between lenders pushing down average mortgage rates has made room for cautious optimism, although interest rates remain high,

There have been predictions for further growth by the end of 2024.

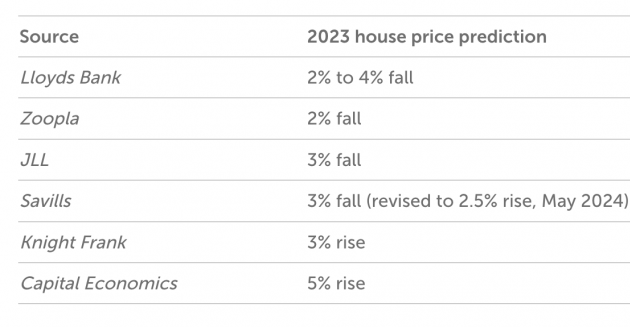

Here’s an overview of some of the 2024 house price predictions from leading market commentators:

These predictions are less severe than those for 2023, which saw experts forecasting average prices to drop by up to 10 per cent. The less drastic drops (and smaller rises) predicted for 2024 show how the property market has recovered after a turbulent period.

Have these predictions come true?

Most market commentators anticipated average house prices to fall this year, with a minority predicting a rise.

Looking at Nationwide’s House Price Index, the average UK property price was up 0.6 per cent year-on-year in April 2024. Meanwhile, Halifax’s data showed a year-on-year rise of 1.1 per cent in April 2024.

If prices continue to increase at the same rate, they could end the year close to Knight Frank’s prediction of three per cent higher than in 2023, potentially falling short of the five per cent rise predicted by Capital Economics.

The current rate of growth suggests that the majority of commentators who forecast house price falls of up to four per cent this year were wide of the mark.

This article is intended as a guide. Always speak to a mortgage professional or property expert if you’re not sure of anything.

Source: Simply Business.